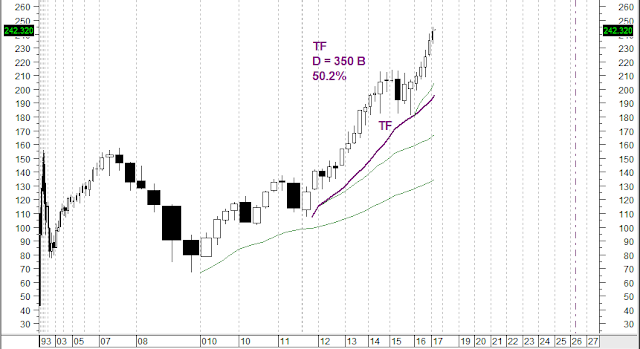

One can easily find a boatload of info and speculation about GE's fundamentals, so I'm not going into that. Instead, let's see what insight can be gained by applying Midas technical analysis to GE on several different time frames.

First, the very long term view, the quarterly bars chart back to 1985...

This, and all the charts in this post, are equivolume, making the horizontal axis linear in cumulative volume, not time. The orange dashed vertical lines are equispaced and identify major bottoms, starting with the crash of 1987. This is an analysis technique developed by Richard W. Arms Jr in his book, "Volume Cycles in the Stock Market" (Equis International, 1994), and which I explain in our book, "Midas Technical Analysis" (Coles & Hawkins, Wiley, 2011). It shows that major bottoms tend to cyclically repeat, not in time but in cumulative volume. And here with GE, we see it's now at a major volume periodic bottom. This is very bullish. [For equal spacing, that 2009 vertical line really should be placed in the middle of the previous large black candle, but the charting software won't let me put it there.]

The green curve S1 is the Midas support curve launched from the 2009 low, and we see that price is now right at that support, also very bullish.

Now let's go up to the next time frame, the monthly bars chart...

Lots going on here. The BottomFinder is more than 90% complete, looking like it will finish within a month. The Money Flow Index oscillator in the upper pane shows that GE is severely oversold now. The blue bars illustrate another analysis technique developed by Arms which he calls Price Projection, which I also explain in our book. Basically, it says that the cumulative volume going across a top will be expended in the subsequent downtrend. This implies here that downward pressure on the stock may continue beyond the end of the BottomFinder, a somewhat bearish indication.

Moving up the time frames again, the weekly bars chart doesn't show anything significant, so I'll omit it here and go directly to the daily bars chart...

This is a significant downtrend since mid September, but it's not an accelerated downtrend because the peaks are not close to their previous red resistance curves, thus we cannot apply a BottomFinder to this trend. But, look at the last five days; this could very well be a washout bottom - heavy volume on strong downward movement, halting and reversing at a major support level.

In summary from all these charts, the preponderance of all these indications is bullish for GE being at a major bottom right now. No guarantees, of course, but enough for me to prepare to enter the stock. The green dashed curve is located above the near-in resistance curve by 3/4 of the average height of the last dozen price bars; that's my buy-stop curve. I'll enter when price hits that curve. And the red dashed curve is similarly located below the bottom, and is where I'll place my stop loss order once I get in.