This is the third blog post on the current status of the

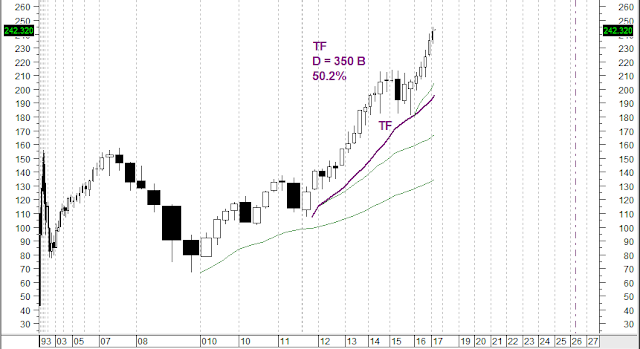

market, here the intermediate term timeframe, as shown on this weekly

bars chart...

An uptrend (not accelerated) started in early February 2016. Its first pullback supported at the first Midas support curve, but the second pullback strongly broke down through the second Midas support curve. This means that uptrend ended. But quite dramatically, last October, the strong down week that ended that trend came to a screeching halt right at the level of the S2 support curve on the monthly bars chart. From there, price bounced up sharply into a new accelerated uptrend to which that TopFincder is fitted. It's about 74% complete now, projected to end at the dashed purple vertical line.

An uptrend (not accelerated) started in early February 2016. Its first pullback supported at the first Midas support curve, but the second pullback strongly broke down through the second Midas support curve. This means that uptrend ended. But quite dramatically, last October, the strong down week that ended that trend came to a screeching halt right at the level of the S2 support curve on the monthly bars chart. From there, price bounced up sharply into a new accelerated uptrend to which that TopFincder is fitted. It's about 74% complete now, projected to end at the dashed purple vertical line.

It's interesting to compare this chart with the long term monthly bars one that I just posted. On the long term chart we see a pullback last fall from which S3 is launched. That pullback corresponds with the location of the start of the TopFomder on this weekly bars chart. It appears that the long term and the intermediate term TopFinders will end at about the same point.